Tesla and Musk starting to recover from bad season. TSMC threatened by potential tariffs. Tesla richer than Broadcom. Ortega having a flat wealth growth. R. Walton richer than Ballmer.

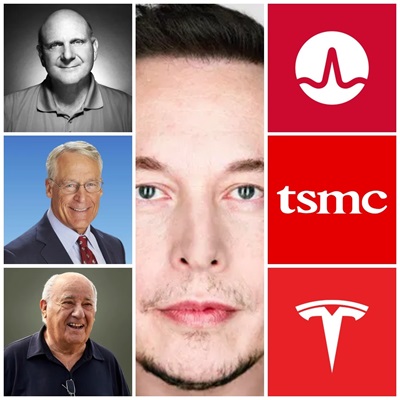

Wednesday and Thursday have finally been days of stock price growth for Tesla, after a season of almost non-stop freefall that started around 21 Jan 2025. The rumors that Tesla was going to get a $400 million contract for armored vehicles from the State Department, could have motivated investors. Even though the contract is unlikely to materialize in the near future, investors may be hoping that Musk will be securing other State Department contracts. The close proximity between Trump and Musk seems to be paying off this time. Investors may be expecting that Tesla will benefit directly or indirectly from the good relationship between Musk and Trump. It is interesting to realize that Musk categorically denied the $400 million contract for Tesla. He said on 13 Feb 2025: “I’m pretty sure Tesla isn’t getting $400M. No one mentioned it to me, at least.” Musk’s net worth increased $10.9 billion on Thursday. Tesla is again richer than Broadcom, with Tesla being upgraded one spot as the 8th richest company in the world, while Broadcom was downgraded one spot to number 9.

The world's largest chipmaker is TSMC. Chip tariffs loom under Trump’s new administration. Trump has made strong accusations against Taiwan, saying that the country is stealing the US chip industry. As a result, Trump has threatened to impose tariffs. This uncertainty may have been an important factor in the negative stock price results that TSMC had on Thursday.

Amancio Ortega’s net worth did not grow at the same rate as other top American billionaires in his league. But his company, Inditex, is still having a solid 2025 in the stock market.

Rob Walton is now the 10th richest person in the world, replacing Steve Ballmer, who was downgraded to 11th. After the DeepSeek AI app shock that happened around the end of January 2025, Microsoft’s stock price has remained flat. The story for Walmart is the opposite, with consistent stock price growth. Walmart’s numbers are impressive: a year to date increase of 16.72%!